Nd Property Tax

NDPTIP

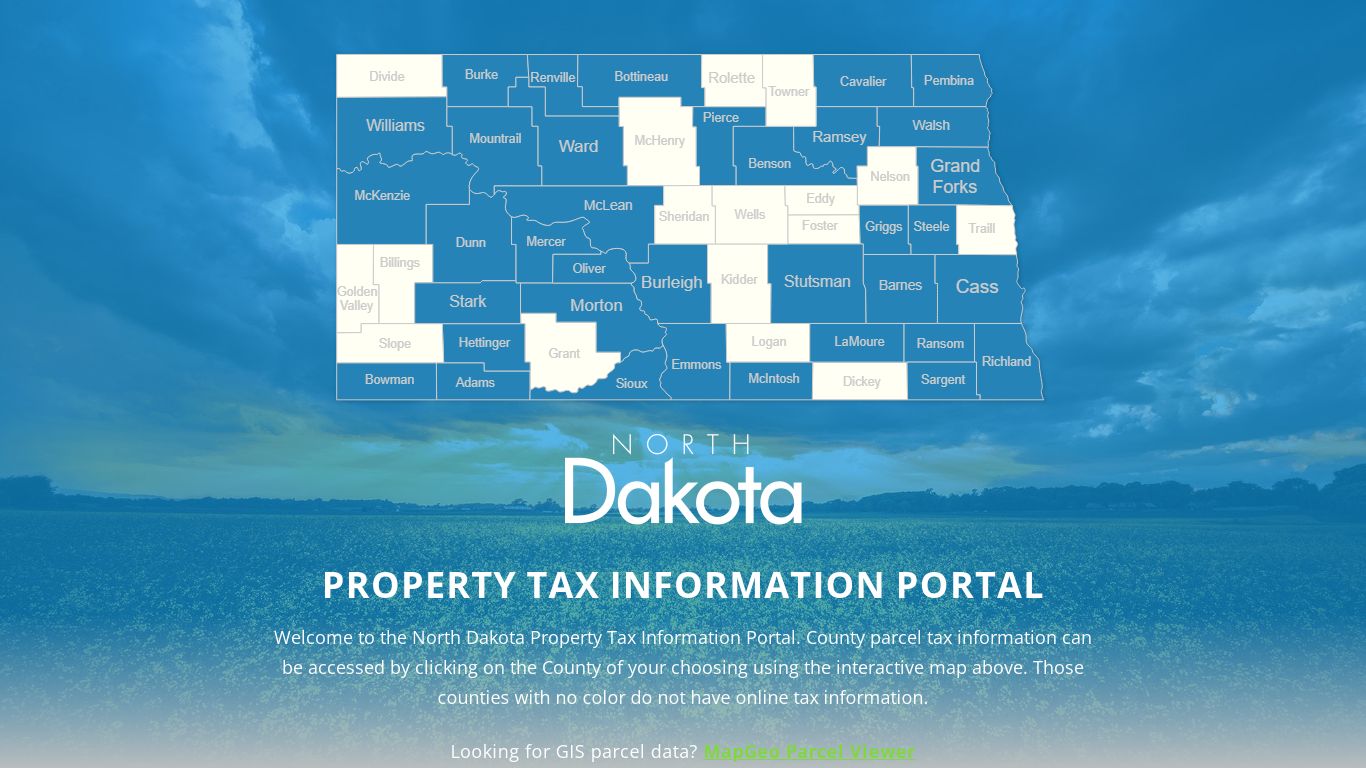

Property Tax Information Portal Welcome to the North Dakota Property Tax Information Portal. County parcel tax information can be accessed by clicking on the County of your choosing using the interactive map above. Those counties with no color do not have online tax information. Looking for GIS parcel data? MapGeo Parcel Viewer

http://ndpropertytax.com/

Learn about Property Tax in North Dakota

Assessed value of all real property in North Dakota is equal to 50% of the market value. Centrally Assessed Property Centrally assessed property is specific types of property, including railroads, investor-owned public utilities, pipelines, and airlines.

https://www.tax.nd.gov/local-government/property-tax

Welcome to the North Dakota Office of State Tax Commissioner

Thursday, June 23, 2022 - 09:00 am Tax Commissioner Brian Kroshus announced today that North Dakota’s taxable sales and purchases for the first quarter of 2022 are up 13.2% compared to the same timeframe in 2021. Taxable sales and purchases for January, February, and March of 2022 were $4.7 billion. Impacts of the Wayfair Decision Four Years Later

http://www.tax.nd.gov/

Property Tax Exemptions in North Dakota

North Dakota exempts all personal property from property taxation except that of certain oil and gas refineries and utilities. Century Code Reference: N.D.C.C. §§ 57-02-04 and 57-02-08

https://www.tax.nd.gov/tax-exemptions-credits/property-tax-exemptions

Property Tax Deadlines in North Dakota

County treasurer provides to the owner of each parcel of taxable property with a property tax amount of $100 or more, a written notice containing information regarding the district budget, true and full value of the owner’s property, and changes in estimated tax and tax levies. (NDCC §57-15-0.2 (2)) August/September

https://www.tax.nd.gov/news/resources/tax-deadlines/property-tax-deadlines

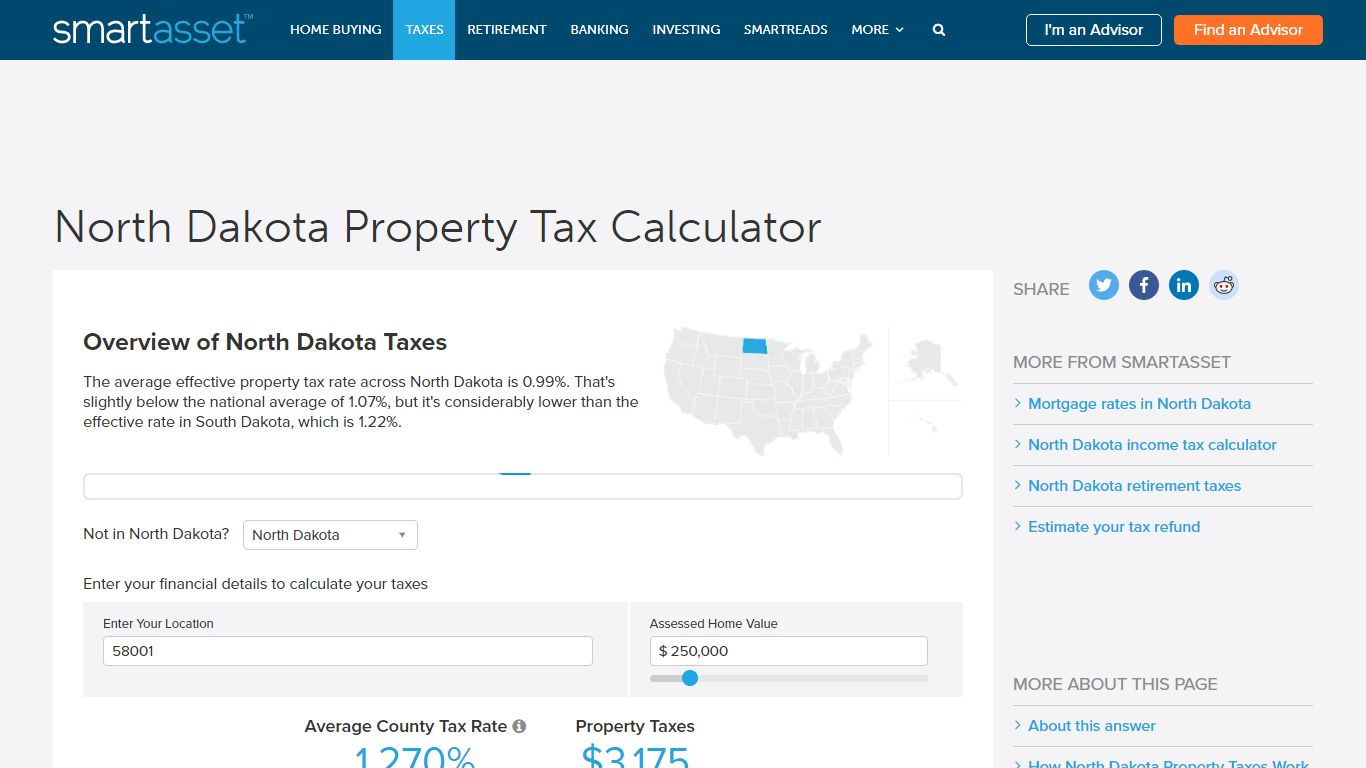

North Dakota Property Tax Calculator - SmartAsset

North Dakota Property Tax Rates. Homeowners in North Dakota face a single tax rate, which is the total of the rates levied by all the tax authorities in their area. This rate is expressed in mills. A mill is equal to 1/10th of a percent, or $1 of tax per $1,000 in taxable value. Another way of calculating tax rates is as effective rates.

https://smartasset.com/taxes/north-dakota-property-tax-calculator

Homestead Property Tax Credit and Renter's Refund - North Dakota Office ...

The Homestead Property Tax Credit and Renter’s Refund are property tax credits available to eligible North Dakotans. Individuals may qualify for a property tax credit or partial refund of the rent they pay, if one of the following requirements is met: 65 years of age or older, OR An individual with a permanent or total disability

https://www.tax.nd.gov/tax-exemptions-credits/property-tax-exemptions/homestead-property-tax-credit-and-renters-refund

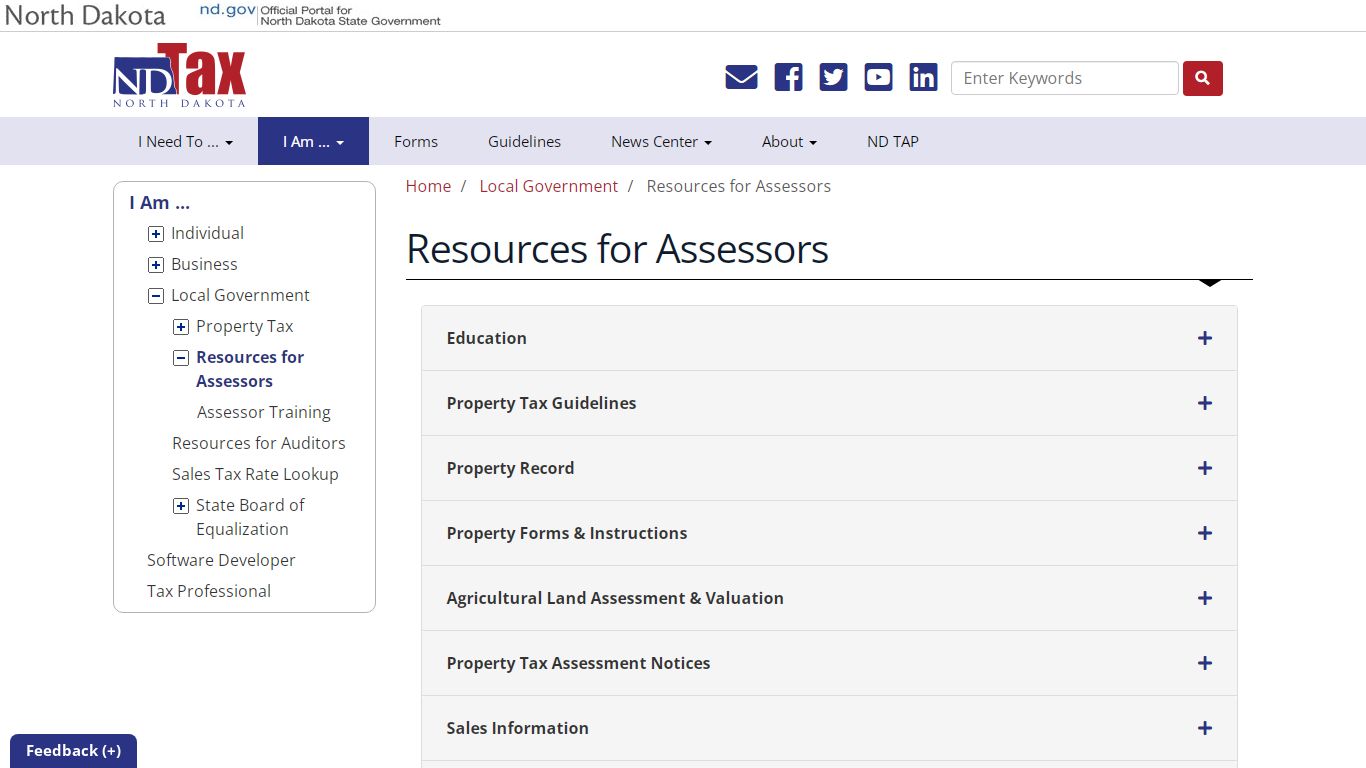

Information for Local Officials Administering Property Taxes

A listing of assessors in North Dakota is available, along with the certification type and continuing education hours earned for each assessor. ... Our property tax guidelines are included in our listing of all guidelines: Property Tax Guidelines. Property Record Property Record. Assessment officials are required to keep an individual property ...

https://www.tax.nd.gov/local-government/resources-assessors

Property & Taxes | Cass County, ND

211 9th Street South Fargo, ND 58103 (701) 297-6000. Website Design by Granicus - Connecting People and Government . View Full Site

https://www.casscountynd.gov/property-taxes

Property & Taxes | Grand Forks County, ND - North Dakota

Pay Taxes Online. Understanding Property Taxes. Township/City Directory. Grand Forks County Office Building 151 South 4th Street Grand Forks, ND 58201. Contact Us Media Inquiries. Created By Granicus - Connecting People and Government ...

https://www.gfcounty.nd.gov/our-county/property-taxes

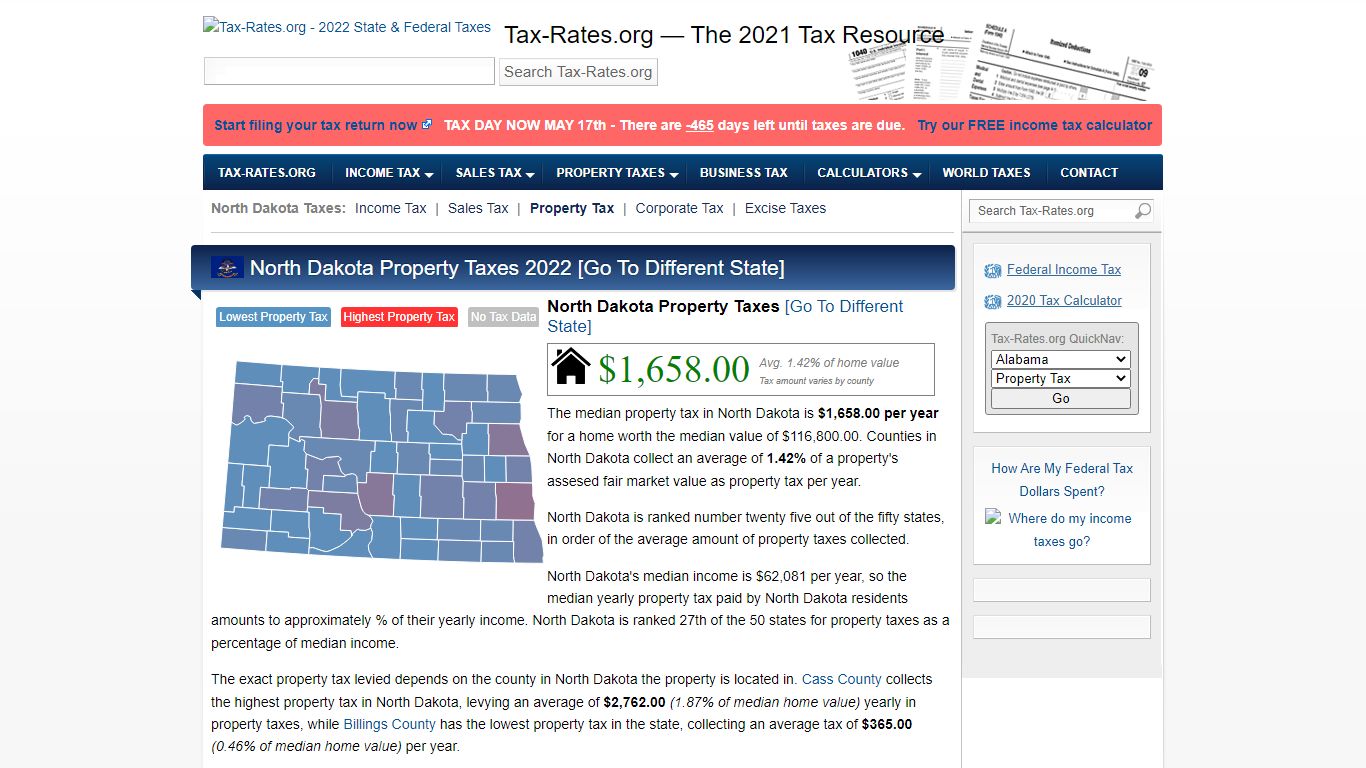

North Dakota Property Taxes By County - 2022 - Tax-Rates.org

The exact property tax levied depends on the county in North Dakota the property is located in. Cass County collects the highest property tax in North Dakota, levying an average of $2,762.00 (1.87% of median home value) yearly in property taxes, while Billings County has the lowest property tax in the state, collecting an average tax of $365.00 ...

https://www.tax-rates.org/north_dakota/property-tax